does new mexico tax pensions and social security

It allows individuals aged 65 and over with a GDI of 51000 or less for married couples and 28500 or less for singles to deduct up to 8000 in income that can be applied to benefits. Its important to note that New Mexico does tax retirement income including Social Security.

Guide To Health Care Services In Mexico Health Care Best Health Insurance Health Care Services

Idaho taxes are no small potatoes.

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

. In 1990 the New Mexico Legislature passed a long and complex bill. Retirement income from a pension or retirement account such as an IRA or a 401k is taxable in New Mexico. For more than half a century after Social Security was enacted in 1935 Social Security benefits were not taxed in New Mexico.

As noted taxable Social Security benefits in New Mexico for tax year 2017 were about 19 billion. Social Security benefits are taxed to the same extent they are taxed at the federal level. If HB 49 gets passed then it would extend to all retirees with social security income.

Otherwise New Mexico treats Social Security benefits for tax purposes in the same way as other income. New Mexico is among a dozen states that tax Social Security benefits. Low-income taxpayers may also qualify for a property tax rebate even if they rent their primary residence.

Hawaii does not tax Social Security benefits. Employer state pension contributions including social security housing retirement and all other aspects covered by the IMSS are tax deductible. Today New Mexico is one of only 13 states that tax Social Security benefits.

Skip to content All About Incomes Questions and Answers All About Incomes Questions and Answers. Now keep in mind that not all of these 13 states tax Social Security in exactly the same way. Currently New Mexico includes all Social Security benefits in the taxable income base though the state provides a deduction that reduces the taxability of all retirement income.

Tax info505-827-0700 or taxnewmexicogov. Localities can add as much as 4313 and the average combined. The new tax changes restrict state taxes on Social Security income to retirees who make more than 100000 a year or joint.

Table 1 shows how states tax public and private pension and Social Security SS income according to NCSL. Assuming an average tax. State Taxes on Social Security.

Beginning with tax year 2002 persons 100 years of age or more who are not dependents of other taxpayers are exempt. Income in excess of the deduction which is 8000 for seniors is taxed at New Mexicos income tax rates. IRS for tax year 2017 and using a guesstimate of the average New Mexico tax rate faced by New Mexico recipients of taxable Social Security benefits.

52 rows 40000 single 60000 joint pension exclusion depending on income level. Information applies to the 2009 tax year unless noted. New Mexico tax rates range from 17 to 59.

The tax costs the average New Mexico senior nearly 700 a year. Up to 20000 exclusion for pension annuity or Def. In New Mexico low income retirees are not taxed on their social security income.

The state taxes all income except Social Security and Railroad Retirement benefits and its top tax rate of 6 65 before 2022 kicks in at a relatively low. Some charge tax only. New Mexico is one of only 12 states that tax Social Security income and it is a form of double taxation since New Mexicans pay income taxes on the money they put into Social Security and then they are taxed again on the benefits they receive.

As with Social Security these forms of retirement income are deductible. However many lower-income seniors can qualify for a deduction that reduces this overall tax burden. Social Security Benefits.

For income that is taxed the lowest Hawaii tax rate is 14 on taxable income up to 4800 for joint. Yes Up to 8000 exclusion. Depending on income level taxpayers 65 years of age or older may be eligible for a deduction from taxable income of up to 8000 each.

We paid 100 of the taxes on our income to the US - less the small interest they Mexico pull from our Mexican accounts as things mature Having said all that - does a US person who is a tax residentdual national of Mexico have to pay taxes to Mexico on their SS disbursements. The New Mexico Legislature on Thursday passed a bill eliminating taxes on Social Security benefits for individuals with less than 100000 in annual income or couples with less than 150000 in. Since no state taxes railroad retirement RR benefits Column 5 shows only Social Security exemptions.

New Mexico Retirement Tax Friendliness Smartasset

New Mexico Retirement Tax Friendliness Smartasset

New Mexico Retirement Tax Friendliness Smartasset

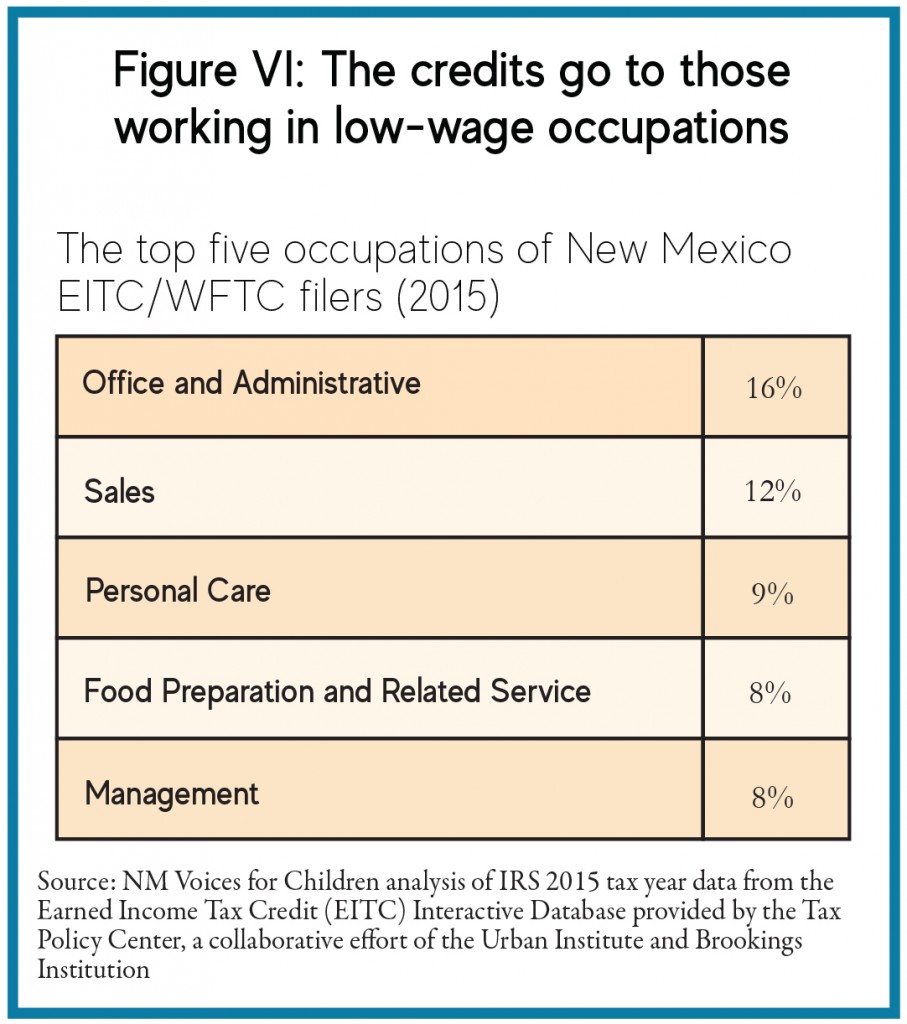

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

Mapsontheweb Infographic Map Map Sales Tax

The Best States For An Early Retirement Early Retirement Life Insurance Facts Life Insurance For Seniors

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Pin On Data Usage Farming Dairy Production

Here Are The U S States With No Income Tax The Motley Fool Income Tax States In America Income

How Do Property Taxes In Texas Work Houston Texas Texas Property Tax

This Map Shows How Taxes Differ By State Gas Tax Healthcare Costs Better Healthcare

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

New Mexico Passes Legislation Including Social Security Tax Cuts Child Tax Credit And Tax Rebates Up To 500 Gobankingrates

The Most Tax Friendly States To Retire Cheyenne Wyoming Wyoming Spring Break Getaways

New Mexico Estate Tax Everything You Need To Know Smartasset

Guide To New Mexico Disability Benefits

Us Expat Taxes Are Further Complicated By Social Security In This Article Americans Living Overseas Find Out What They Need To K Social Security Expat Social

New Mexico May Limit Or Scrap Tax On Social Security Income New Mexico News Us News

Are Social Security Benefits Taxable You Better Believe It Uncle Sam Can Tax Up To 85 Of Your M Social Security Benefits Social Security Retirement Benefits